FOR PYTHON QUANTS

An Exclusive Bootcamp Series Brought To You By CQF Institute And The Python Quants

LONDON TUE 12. TO THU 14. NOVEMBER 2019

The Bootcamp Series for those working in Finance or doing Algorithmic Trading and using Python.

UNIQUE COMBINATION

This bootcamp series is the only one in the world to focus exclusively on Python for Quantitative Finance. Do not miss it if you work in finance and use Python.

THE SERIES IN NUMBERS

For those quants believing more in numbers than just words.

1000+

NYC + LONDON

This London series is the ninth of its kind. During the last eight more than 1000 people attended the bootcamp and conference days.

3

LONDON

We bring you three intensive bootcamp days during which we start from scratch with Python for Finance and end up implementing automated algorithmic trading strategies in real-time.

10

TOPICS

Expect a fast-paced schedule during the bootcamp days with more than 10 topics of relevance covered. Master Python for Finance and Algorithmic Trading.

2

STRONG PARTNERS

The CQF Institute is amongst the world's most renowned education bodies for Quantitative Finance. The Python Quants Group focuses on

Python for Quant Finance.

PYTHON BOOTCAMPS

Intensive Python bootcamps about Python for Finance for professionals and academics who want to make their next step in their career.

The bootcamps take place at Fitch Learning The Corn Exchange, 55 Mark Lane (2nd floor), London, EC3R 7NE in London.

The Python Infrastructure & Basics bootcamp will focus on setting up Python environments for interactive financial analytics and application deployment. Dr. Hilpisch will cover a number of important tools and Python packages; illustrating the use of such packages as NumPy and pandas. Introduces participants to a trading platform and its API as well as the Python wrapper packages; examples cover basic and first steps, working with historical financial data as well as streaming data and visualization.

The Trading Strategies bootcamp day will introduce participants to certain techniques to analyze historical financial data, in particular vectorized backtesting for algorithmic trading strategies based on typical financial indicators. Different classification algorithms to derive algorithmic trading strategies will be discussed.

The Automation bootcamp: In order to be able to deploy and run algorithmic trading strategies in real-time, it is necessary to deal with streaming data and to transform offline algorithms to online algorithms; this bootcamp covers basic concepts in this regard. Important aspects when it comes to the robust and reliable deployment of algorithmic trading code, among others, cloud deployment, logging and monitoring will be discussed.

TICKETS

Tickets to attend either in London or online will gain access to videos of your chosen event(s) on demand for up to 60 days.

PYTHON INFRASTRUCTURE

Tue, 12. November 2019, One-day

£

595

-

Setting up Python environments for interactive financial analytics and application deployment.

-

A number of important tools and Python packages, illustrating the use of such packages as NumPy and pandas.

-

Introduces participants to a trading platform and its API as well as the Python wrapper packages.

-

Examples cover basic and first steps, working with historical financial data as well as streaming data and visualization.

TRADING STRATEGIES

Wed, 13. November 2019, One-day

£

595

-

Introduce participants to certain techniques to analyze historical financial data, in particular vectorized backtesting for algorithmic trading strategies based on typical financial indicators.

-

Different classification algorithms to derive algorithmic trading strategies will be discussed.

AUTOMATION

Thu, 14. November 2019, One-day

£

595

-

You will be able to deploy and run algorithmic trading strategies in real-time, it is necessary to deal with streaming data and to transform offline algorithms to online algorithms

-

Important aspects when it comes to the robust and reliable deployment of algorithmic trading code.

-

Cloud deployment, logging and monitoring will be discussed.

BOOK A PACKAGE

To Book a package and cliam your discount email us at events@cqfinstitute.org

25%

Discount For Students applies to students.

15%

Discount For Group Bookings when registering 3+ delegates

15%

Discount When booking at least two bootcamps.

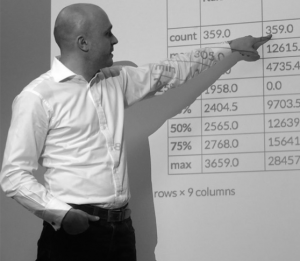

IMPRESSIONS FROM PREVIOUS EVENTS

Get a feel for the energy and flow at the For Python Quants event series.

VENUE

The bootcamps take place at Fitch Learning The Corn Exchange, 55 Mark Lane (2nd floor), London, EC3R 7NE in London.

MEET THE TEAM

ORGANIZERS

OUR SPONSORS

Fitch Learning is a global leader in financial education with over 25 years of experience in delivering specialized, technical training to the finance community.

Stay informed about the latest of Python for Quant Finance.

The Experts in Data-Driven and AI-First Finance with Python. We focus on Python and Open Source Technologies for Financial Data Science, Artificial Intelligence, Algorithmic Trading and Computational Finance.